Insurance for Clinical Investigations

Manufacturers who conduct clinical investigations of their medical devices must take out insurance. This requirement is established by the MDR and IVDR (among others).

Find out how much insurance costs and what you should look out for when choosing an insurance company, firstly to avoid unnecessary insurance premiums and secondly to manage your financial and legal risks and not be left on your own in the event of a claim.

1. Legal obligation to insure clinical investigations

a) Regulatory requirementst

Article 69 of the EU Medical Device Regulation (MDR) states:

“Member States shall ensure that systems for compensation for any damage suffered by a subject resulting from participation in a clinical investigation conducted on their territory are in place in the form of insurance, a guarantee, or a similar arrangement that is equivalent as regards its purpose and which is appropriate to the nature and the extent of the risk.”

The IVDR establishes the same requirements in Article 65. The only difference is it uses the term “performance study” instead of “clinical investigation”.

Section 20 of the MPG (German Medical Devices Act) (general prerequisites for clinical investigations) establishes/established even more specific requirements, e.g., with regard to the value of the sum insured or the requirement that the insurance be taken out with an “insurance carrier authorized to conduct business in Germany[A1] ”.

Section 26 of the MPDG (Medizinprodukte-Durchführungsgesetz [German Medical Devices Implementation Act])[A2] (insurance cover) establishes the same requirements as the MPG:

(1) Zugunsten der von einer klinischen Prüfung oder einer sonstigen klinischen Prüfung betroffenen Personen ist eine Versicherung bei einem Versicherer, der in einem Mitgliedstaat der Europäischen Union oder in einem anderen Vertragsstaat des Abkommens über den Europäischen Wirtschaftsraum zum Geschäftsbetrieb zugelassen ist, abzuschließen.

(2) Die abzuschließende Versicherung muss für Schäden haften, wenn bei der Durchführung der klinischen Prüfung oder der sonstigen klinischen Prüfung ein Mensch getötet oder der Körper oder die Gesundheit eines Menschen verletzt wird, und auch Leistungen gewähren, wenn kein anderer für den Schaden haftet.

(3) Der Umfang der abzuschließenden Versicherung muss in einem angemessenen Verhältnis zu den mit der klinischen Prüfung oder der sonstigen klinischen Prüfung verbundenen Risiken stehen und auf der Grundlage der Risikoabschätzung so festgelegt werden, dass für jeden Fall des Todes oder der fortdauernden Erwerbsunfähigkeit einer von der klinischen Prüfung oder der sonstigen klinischen Prüfung betroffenen Person mindestens 500 000 Euro zur Verfügung stehen.

MPDG, Section 26

It is important that the subjects are the beneficiaries of the insurance, in other words, that the subjects acquire a direct claim against the insurer.

b) Exceptions to the obligation to take out insurance

If the medical device already bears the CE marking and you are not conducting a clinical investigation or “other clinical investigation”, there is no obligation to take out insurance.

Further information

Read more on the terms “clinical investigation” and “other clinical investigation” here

An exception is also made if no additional invasive or burdensome investigations are performed.

c) Review of the insurance

The ethics committees and the higher federal authority (generally, BfArM) review whether insurance cover has been taken out (if it is legally required) during the application process.

Conversely, insurance companies require advance approval from the ethics committees and the higher federal authority to provide insurance cover.

2. Damage (not) covered by insurance

Obviously, the insurance must ensure compensation for any damage to a subject’s health that occurs as a result of their participation in a clinical investigation.

However, the insurance companies usually only pay compensation for specific material damage, such as:

- The costs of curative treatment

- Loss of ability to work/compensation for work that the subject can no longer perform, e.g., in the form of a pension or maintenance payments (especially in the case of a death)

- Increased expenses, e.g., for a stair lift, lawyers (where applicable), etc.

In contrast, the insurance companies do not pay out for:

- The aggravation of pre-existing health problems that would have occurred even if the subject had not participated in the clinical investigation

- Damage to health caused by deliberate non-compliance with the investigation staff's instructions

The insurance cover usually also lapses if the device is recalled. However, it continues to cover the consequences of any actions taken up to the date of the recall, including any actions taken as a result of the recall.

3. Duration and deadlines for insurance

The term of the insurance should cover the period from the first patient in through to the last patient out/last visit. This includes all screening visits and possible follow-up visits.

Manufacturers must also pay attention to the extended reporting period. This is the period during which it can notify the insurance company of harm caused to a subject in the investigation. In Germany, an extended reporting period of 10 years is standard. In other countries, it can range from 3 months to 10 years.

Insurance companies usually grant longer extended reporting periods for investigations involving children.

4. Cost / insurance premiums

a) Factor influencing the cost

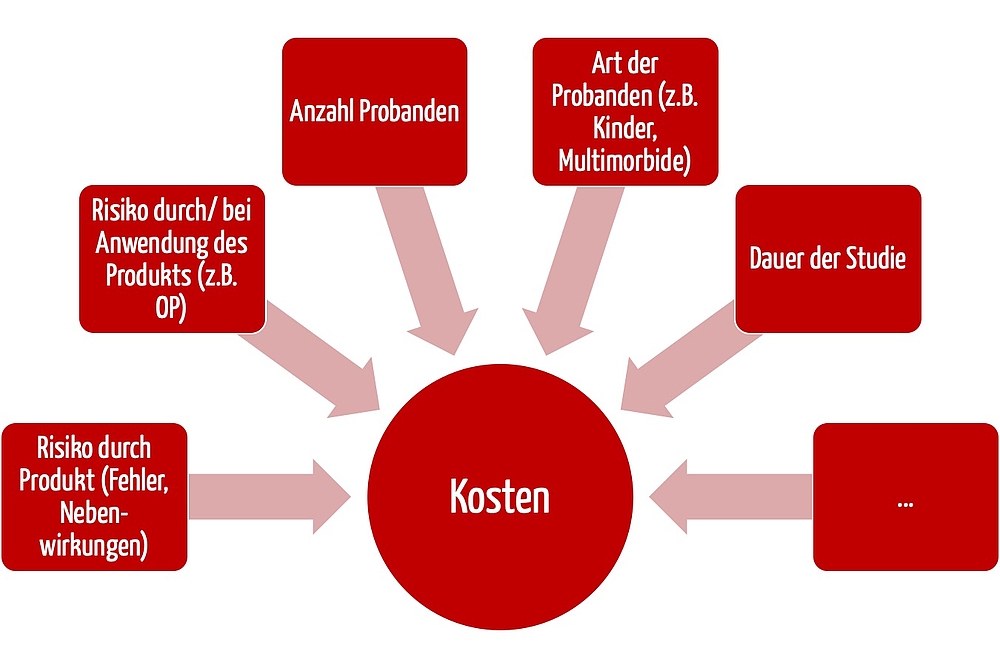

The cost of insurance cannot be quantified as a flat rate. It depends on several factors, for example:

- Patient risks: A clinical investigation with a non-invasive medical device has lower insurance costs than a clinical investigation with high-risk implants or operations.

- The duration of the clinical investigation also affects the cost. Most investigations last several months or a few years. But there is insurance available even for studies lasting more than eight years.

- The number of subjects also significantly affects the cost, often proportionally. Compared to drug trials, most clinical investigations “only” includes tens or hundreds of subjects.

- Lastly, the costs depend on the subject population - children and subjects with severe pre-existing conditions push up the cost.

b) Cost

Manufacturers usually have to pay the cost for the entire duration of the clinical investigation in full at the start of the clinical investigation. For non-critical studies with few subjects, the cost starts from around EUR 1,500 and there is not really a maximum price. However, the legislator has helped us by providing an estimate:

The German Medical Devices Adaptation Act [Medizinprodukteanpassungsgesetz] has estimated the costs that will be incurred by German states who sponsor clinical investigations themselves - e.g., through university hospitals - and who therefore have to insure themselves. The law states:

„Der größte Kostenzuwachs auf Landesebene, 525 Tsd. Euro jährlich, entsteht durch die zukünftig auch für wissenschaftliche klinische Prüfungen von Medizinprodukten erforderliche Probandenversicherung.“

MPEUAnpG (Medizinprodukte-EU-Anpassungsgesetz [EU Medical Devices Adaptation Act])

The authors continue:

„Die Abschlussgebühr für die Versicherung fällt einmalig an und beläuft sich schätzungsweise auf circa 5 Tsd. bis 30 Tsd. Euro für eine klinische Prüfung (im Durchschnitt als sehr grobe Näherung also 17,5 Tsd. Euro). Die Versicherer kalkulieren die Abschlussgebühr für die Versicherung am Risiko (abhängig vom Medizinprodukt) und an der Anzahl der Probanden.“

5. Local and regional features

The regulatory requirements differ between states and markets. These differences affect for example:

- Minimum sum insured

- Type of insurance, e.g., liability insurance for physicians, and special insurance for the radiation application

- Damages that have to be insured (personal injury, damage to property, compensation for pain and suffering)

- The obligations regarding information to be sent by and to sponsors, study sites, subjects, authorities and insurance companies

- The obligation to provide translations and the permitted languages

- Number of investigators and requirements for study sites

- Reasons, deadlines and methods of reporting incidents and changes

- Contact persons and investigators based in the respective country

a) Specific features in Germany

In Germany, the minimum sum insured is EUR 500,000 per subject and at least EUR 5,000,000 per protocol.

If a study requires the use of radiation, a radiation protection liability insurance, also with a minimum sum insured of EUR 500,000, is required. The sponsors must also pay compensation for pain and suffering.

Although travel accident insurance is not legally required, more and more ethics committees are recommending it. This type of insurances covers personal injuries suffered by the subjects on their way to and from the trial site.

b) Switzerland:

Switzerland classifies studies in risk category A, B or C. The required minimum sum insured depends on these categories:

Risk class | Per protocol [CHF] | Personal injury per subject [CHF] | Damage to property [CHF] |

A | 0 | 0 | 0 |

B | 3,000,000 | 250,000 | 20,000 |

C | 10,000,000 | 1,000,000 | 50,000 |

The Swiss insist on a local representative if the sponsor is based outside Switzerland.

c) Austria

In Austria there is an obligation to take out

- Personal injury insurance

- Liability insurance for investigators

- Criminal liability insurance for investigators

The minimum sum insured for personal injury insurance is EUR 3,500,000 per protocol or EUR 500,000 for trial participant.

6. Other manufacturer/sponsor obligations

The standard manufacturer and sponsor obligations, which both the insurance companies and the legislation demand, include:

- Providing information on the clinical investigation and side effects to the subjects participating in the clinical investigation

- Making a reference to the existence of insurance and the obligations

- Notifying all changes that could lead to an increase in the risk for subjects, in particular changes to the protocol, the extension of the study and the revision of the subject information

- Reporting any potential damage to health resulting from the clinical investigation

- Taking all necessary measures to minimize damage as far as possible

N.B!

The consent of the insurance company is required for the insurance cover to continue unchanged. Therefore, you must inform them before you amend the study protocol.

7. Taking out insurance

a) Information to be sent by the CRO/sponsor to the insurance company

An insurance company needs, at least, the following information before it can provide a quote:

- Study protocol (the synopsis is usually sufficient) including

- Study objective

- Number of subjects

- Description of the subjects, e.g., pre-existing and concomitant diseases

- Risk analysis

- Number of study sites

- Countries

- If available, patient information

To prepare the insurance policy, the insurance company also needs to have the study title in the language of the country and the full address of the study sites. The insurance company will then ask the sponsor for additional country-specific information and, if necessary, will agree any special payment arrangements.

b) Choosing insurance

Manufacturers and sponsors should not just look at price when choosing insurance. They should also take into account other factors to ensure that they take out suitable and legally compliant insurance cover with no complications.

- The insurance company should specialize in life sciences and clinical studies and have explicit experience with the clinical investigation of medical devices. Otherwise, it will not have sufficient knowledge of the regulatory requirements.There is also a threat of the usual cost frameworks in the pharmaceutical sector.

- A personal contact is helpful - particularly in the event of a claim.

- The insurance company must have its headquarters in the EU, or even in Germany.

- The insurance company may have access to particularly sensitive personal data. Therefore, it is essential that the company operates in accordance with the relevant data protection regulations in the EU or in the study country and that it confirms this in writing.

8. Conclusion, summary

Among other things, the tougher requirements of the MDR and IVDR on the equivalence of comparator devices make it more likely that manufacturers will have to demonstrate the benefit, performance and safety of their medical devices in clinical investigations. Insurance policies have to be taken out for these clinical investigations.

Manufacturers should be aware of the regulatory requirements for this insurance and should also take into account the country-specific differences. Being precise when defining the study objectives and preparing the study protocol will not just help to determine the costs as accurately as possible, it will also help to formulate them.

Authorship and declaration of interests: Steffi Elschner provided essential content for this article. Her company helps companies take out insurance for clinical investigations. There is no commercial relationship between her or her company and the Johner Institute. There is no conflict of interest.